How to Validate Transactions on the SQR400 Bank Account Flashing Software May 3, 2024 – Posted in: SQR400 Guides

In an ideal scenario, when funds are transferred from one person to another, both parties involved are usually notified by their banks or financial institutions.

Depending on the preferred mode of communication, each party receives debit or credit alert notifications via text messages, electronic mail, in-app digital receipts, and sometimes a combination of various channels.

Similarly, the SQR400 bank account flashing software generates confirmatory receipts and SWIFT message documents for every successful flash fund transaction.

Confirmatory receipts and debit notifications usually serve as interim validation for successful transactions from the issuing bank, pending the arrival and processing of transferred funds by the receiving bank.

Other times, the nature of the transactions and other constraints like network downtime may cause extended delay periods between banks and financial institutions.

However, the SQR400 bank account flashing software utilizes robust frameworks and SWIFT network infrastructure to ensure flash funds get delivered at lightning speeds to recipients.

This article provides an in-depth explanation of how to validate flash fund transactions on the SQR 400 and how to understand and interpret SWIFT message documents.

Without further ado, let’s dive straight in.

Quick Recap on Flash Funds and Bank Account Flashing Software

Bank account flashing software are application programs that enable users (generally smart hustlers) to send flash funds to their clients regardless of the recipient’s bank or financial institutions.

Simply put, bank account flashing software enables smart hustlers to remotely credit their clients by depositing flash funds into their bank accounts within minutes.

Flash funds, also referred to as pseudo-funds, are digital currencies lacking real-world significance or intrinsic value and only exist to give recipients the illusion of real money deposited into their bank accounts.

Bank account flashing is not devoid of intricacies and complex processes thus smart hustlers rely on the SQR400 bank account flashing software as their go-to for all types of clients.

For a detailed breakdown of how bank account flashing works and how to get started with the SQR400, refer to our comprehensive guide on bank account flashing software.

Validating Bank Account Flashing Transactions on the SQR400 (SWIFT Confirmation)

Unlike generic applications, the SQR400 bank account flashing software simplifies the process of transferring flash funds to recipients globally.

With the sender and receiver’s details entered correctly, all it takes is a few clicks and flash funds up to 500M Euros or USD get transferred instantly.

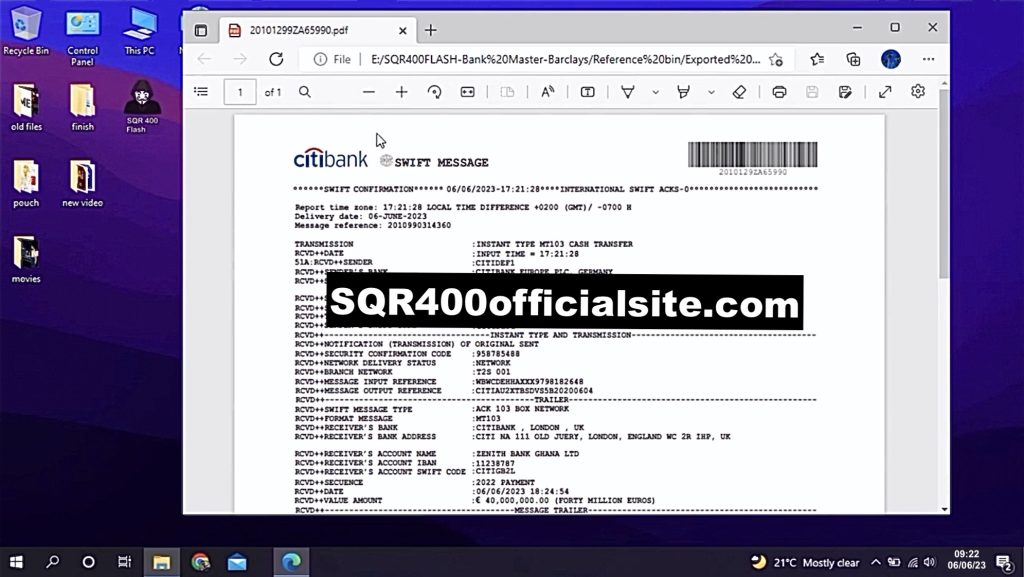

If flash funding transactions are successful, a confirmatory notification appears on the SQR400 dashboard specifying the SWIFT messaging format utilized as well as the preferred transaction currency, beneficiary’s account information, and a timestamp.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) messaging format specifies the nature of financial transactions and provides specific instructions for receiving banks or financial institutions.

For detailed information about each transaction, the SQR400 enables users to export or print out a comprehensive copy of the SWIFT messaging format for every successful transaction.

Understanding the SQR400 SWIFT Messaging Formats Confirmatory Receipts

SWIFT messaging formats confirmatory receipts are detailed documents generated whenever successful financial transactions occur between banks and/or financial institutions.

It serves as validation of payment made from the issuing bank, indicates the nature of the transaction, and specifies instructions such as fees applied (if any) for the beneficiary’s institution.

The SQR400 SWIFT messaging formats confirmatory receipts are divided into five sections: the SWIFT confirmation international SWIFT ACKS-O, instant type and transmission, trailer, message trailer, and interventions.

In the following section, we analyze and interpret every section on the SQR400 bank account flashing software confirmatory receipt.

Section 1: SWIFT Confirmation International SWIFT ACKS-0

This section specifies the type of SWIFT messaging format utilized per transaction, the delivery date, and the timestamp indicating the local time difference between the sender and the receiver. It also details the sender’s account information and the issuing bank’s SWIFT code for ease of identification.

Section 2: Instant Type and Transmission

The SWIFT network security confirmation code is specified in this section including the network delivery status, the SWIFTNET branch utilized, and message input/output reference from the issuing and receiving bank or financial institution.

Section 3: Trailer

It is the most critical section in the SQR400 flash funds confirmatory receipt. It reiterates the SWIFT messaging format per transaction and specifies the recipient’s bank account information.

Detailed information about the receiving bank or financial institution’s IBAN and SWIFT code is indicated as general information about the institution’s physical address and geographical region.

This section is the most crucial part of the SQR confirmatory receipt as it indicates the amounts of flash funds to be credited and the description or purpose of the transaction. It also specifies instructions for disbursing transferred funds by the receiving bank or financial institution.

Section 4 & 5: Message Trailer and Interventions

The final sections of the SQR400 SWIFT messaging format confirmatory receipt include an abridged version of the SWIFTNet report, highlighting the system operator and a timestamp indicating when the report was generated. At the end of the report, the tagline boldly reads “End of Transmission.”

Final Thoughts on Validating SQR400 Bank Account Flashing Transactions

Bank account flashing is an intricate process that demands specialized tools, software re-engineering practices, and a dedicated team of developers to pull off.

To mitigate the complexities of bank account flashing, the SQRGroup developed the SQR400 bank account flashing software to simplify the process of sending flash funds globally.

Regardless of the recipient’s bank or financial institution, flash funds or pseudo-funds can be deposited using an array of SWIFT servers on the SQR400 software.

For every successful transaction, the SQ400 generates a SWIFT messaging format confirmation receipt that serves as interim validation for each transaction.

To get started and learn more about bank account flashing, purchase the SQR400 bank account from our shop or reach out to our support team today!