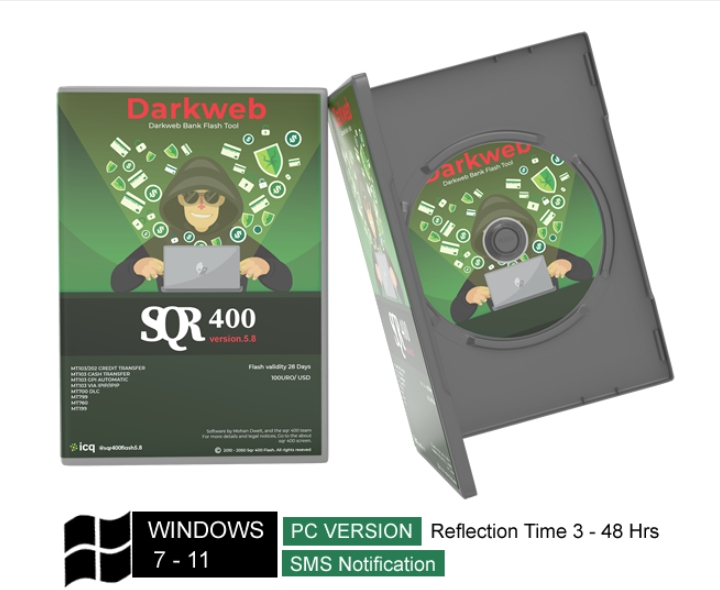

The Role of SWIFT Servers in Bank Account Flashing Software April 13, 2024 – Posted in: SQR400 Guides

Though various types of bank account flashing software exist, they all share a commonality; the use of SWIFT servers to facilitate the transfer of flash funds.

Flash funds as previously defined, are pseudo-funds or digital currencies lacking monetary value or real-world significance.

When deposited into existing bank accounts, flash funds can potentially alter or increase the recipient’s available balance while maintaining its accessibility to withdrawal requests.

As a mirage, pseudo-funds or flash funds appear only for a short while, give off the appearance of real money then disappear into nothingness leaving no trace behind.

SWIFT which is short for Society for Worldwide Interbank Financial Telecommunication, is a private network messaging system that enables banks and financial institutions to communicate simultaneously.

Using a diverse network of SWIFT servers, information about financial transactions and money transfers gets sent from one bank to the other, enabling faster local and international transactions.

Banks and financial institutions that utilize the SWIFT Network get assigned an eight or eleven-digit character known as SWIFT Code which serves as a unique identifier within the network.

This blog post delves into the nitty-gritty and inner workings of SWIFT servers, their roles in facilitating flash funds transfers, and various types of SWIFT messaging formats utilized by bank account flashing software.

Without further ado, let’s dive right in.

Overview of Swift Servers & Bank Account Flashing Software

At the core of bank systems messaging infrastructure lies SWIFT Servers. These servers provide secured pathways that enable efficient transmission of SWIFT messages throughout the SWIFT Network.

The SWIFT Network (SWIFTNet) is a proprietary messaging platform used to transmit SWIFT messages between banks and financial institutions.

Bank account flashing software like the SQR400 flashing software, exploits weaknesses and vulnerabilities within SWIFT networks.

When a loophole or back door is identified, bank account flashing software encroaches into such frameworks and deploys malware that remains undetected for long periods.

This gives bank flashing software sufficient time to establish a foothold and base for its operations within compromised systems.

As its activities remain undetected by existing bank security protocols, bank account flashing software intercepts modifies, and sends SWIFT messages to various banks and financial institutions to credit designated receivers with pseudo-funds or flash funds.

Unauthorized access and privileges of such magnitude are possible when computer servers or cloud service providers that host bank system messaging platforms and infrastructure get compromised.

Types of SWIFT Messaging Formats on the SQR400 Software

There are various types of SWIFT messaging formats, each serving specific purposes that are often tailored to the needs of different banks or financial institutions.

In this section, we discuss the instruments and SWIFT messaging formats supported by the SQR400 bank account flashing software.

They include: MT103 Cash Transfer, MT103/202 Credit Transfer, MT103 GPI Automatic, MT103 via IPIP/IPID, MT700 DLC, MT760 MT799 and MT199 SWIFT messaging format.

- MT103 Cash Transfer: This is the most widely used and accepted standard swift messaging format among banks and financial institutions for local and international cash transfers.

- MT103/202 Credit Transfer: This involves a combination of two swift messaging formats typically used for larger cash transfers and provides instructions or additional information on how funds should be disbursed.

- MT103 GPI Automatic: This is an enhanced version of the MT103 messaging format that supports the Global Payment Innovation (GPI) Initiative. Some of its perks include real-time tracking, improved payment confirmation, and seamless cross-border integration.

- MT103 via IPIP/IPID: Unlike the traditional swift messaging format, this enhanced MT103 swift messaging format utilizes internet protocols for faster transactions and enhanced security.

- MT700 DLC & MT760: Both MT700 and MT760 are utilized by financial institutions for issuing documentary letters of credit (DLC), bank guarantees, and standard letters of credit.

- MT199 vs MT799: The difference between the MT199 and the MT799 swift messaging format is that the former offers more flexibility for customized swift messages while the latter doesn’t. Both formats, however, are used for general inquiries and confirmation of the availability of funds among financial institutions.

Such an arsenal of supported swift messaging format, enables the SQR400 bank account flashing software to send flash funds globally, regardless of the recipient’s bank account or financial institution.

How to Get Started with the SQR400 Bank Account Flashing Software

The SQR400 is the most suitable choice among bank account flashing software, as it boasts an array of SWIFT servers that facilitate seamless transfers of flash funds.

The SQR400 servers are situated at prominent locations, some of which include: the CITI GERMANY Server, DB GERMANY Server, HSBC UK Server, and RBC Canada data center.

To get started with the SQR400 bank account flashing software, simply head over to our shop, place an order, and follow the prompts.

If you’re new to bank account flashing and need help navigating this space, we’ve created a complete guide on bank account flashing software and a step-by-step process on how to send flash funds.

Final Thoughts on SWIFT Servers for Bank Account Flashing Software

Currently, the SWIFT Network (SWIFTNet) is the most widely accepted and standardized communication network that facilitates communication and transactions among banks and financial institutions globally.

This network ensures fund transfers from various financial institutions are seamless and completed promptly.

Popular bank account flashing software like the SQR400 account flasher relies on such robust infrastructure to send flash funds to any recipient regardless of their banks or financial institutions.

The intricacies of its operations ensure its activities within the SWIFTNet stay undetected and untraceable for long periods.

If you need help getting started with the SR400 bank account flashing software when dealing with clients, reach out to our support team (the SQR Group) and we’ll be more than willing to help out.